How To Best Budget Your Money

May 01, 2024

By My Growing Pains

If you think you can live life successfully without budgeting, you are horribly wrong. Budgeting is absolutely necessary. You need to always be on top of where your money is going, and budgeting can help with that. So, what is budgeting? Budgeting is a financial method used to help you plan where and how you spend your money.

There are many ways to make a budget plan for yourself, but for now, I’ll describe what you can do. I track my budget and my overall finances via Sheets, the google equivalent of Microsoft excel. It’s easier to access on any device and because it operates on a cloud, I can access my information on the go.

It’s important to understand that not everyone will have the same budget plan. After expenses, some will have more money left over, and some wont. It’s okay, just make sure you do what is best for you and your financial situation.

How to Create a Budget

- 1. Look over your income

- 2. Track all of your expenses

- 3. Do the Math

Examine Your Income

It’s important to understand that not everyone will have the same budget plan. After expenses, some will have more money left over, and some wont. It’s okay, just make sure you do what is best for you and your financial situation.

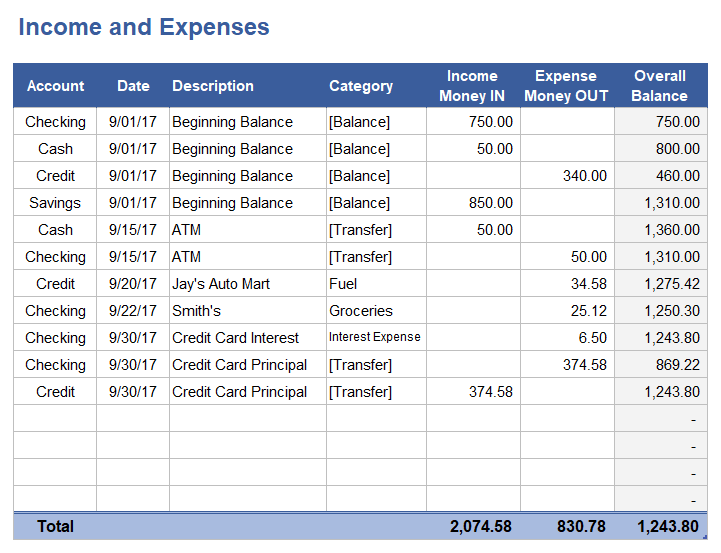

Look at this example of an income tracker:

Track Your Expenses

It’s important to understand that not everyone will have the same budget plan. After expenses, some will have more money left over, and some wont. It’s okay, just make sure you do what is best for you and your financial situation.

- FIXED EXPENSES - expenses that rarely change. These expenses include rent, auto loans, insurance payments, utilities, etc.

- vARIABLE EXPENSES - as described in the name, these are expenses that vary. This includes clothes, groceries and eating out, luxury recreational activities, gas, and medical bills.

- INTERMITTENT EXPENSES - expenses that are random but still important, like copays or coinsurance, basically expenses that occur rarely and are dependent upon your circumstances.

- DISCRETIONARY EXPENSES - if fixed expenses are things you need, discretionary expenses are wants. These expenses include things such as eating out, nails, barber or salon, gifts, etc. Basically, things that will give you instant gratification.

- TIP: I list out things I want to watch and have a maximum of three streaming services that consist mainly of what I wish to watch. That way I don’t have any surprise charges on my card.

Do The Math

after my income and expenses are analyzed, I simply subtract. So, I first subtract my mandatory expenses from my income as these are the most important. With the remaining amount, I take some money out to put into my savings.

I then subtract my miscellaneous expenses and lastly, I subtract the expected expenses from my luxury activities from my income. Whatever is left is what I can use for whatever I might need to. If I have a large amount left, does this mean I should spend it all, no. Do not do this.

Tips To Keep In Mind

Now look, checks are not an archaic practice. For big purchases, some companies require checks, so do not skip learning how to write and read a check.

- Always plan for emergencies

- start an emergency fund. This can be in your savings account or stored in a completely different, safe space.

- Create realistic goals

- stay updated on economic news and plan accordingly. If one of your streaming services is about to increase the price by $5, maybe see if you really need it.

- Be Kind to yourself

- It’s not always going to be a perfect run every time, especially since it’s your first time, so, be patient with yourself.

- Review your budget plan often

- once a month, dedicate some of your time to adjusting your budget if needed. Look at your monthly expenses and if anything is out of the ordinary, don’t hesitate to change it.

Conclusion

Budgeting can and will help you take control of your finances. Yes, there are things that happen out of your control, but when you know where all of your money is going, it’ll give you the confidence to tackle any situation.

Written by Doreen Chirwa · My Growing Pains