How Bank Accounts Work

May 01, 2024

By My Growing Pains

Most people open their bank accounts around the age of 16, with the assistance of their parents. Typically, I’d assume around this time, we are getting our first ever job, so we need somewhere to store that money.

Bank accounts store our money and can sometimes make us more based on how you go about it. The convenient thing about the United States is that each state has many banks. From nationwide bank franchises, like Wells Fargo or Chase, to local banks that you can find around any corner. It seems we are never short of options, so do your research on the banks near you, read reviews, and choose which one you want.

There are four types of bank accounts:

- 1. Checking accounts

- 2. Savings Accounts

- 3. Money Market Accounts

- 4. Certificate of Deposit Accounts

Let’s go in depth with each of these accounts.

Checking Accounts

Did you know there were different types of checking accounts that a person can open? There are more than four, but the most commonly used one is the standard checking account.

The standard checking account is a deposit account that often comes with characteristics such as access to an ATM, online banking, a debit card, and even access to a check book. It allows you to deposit, transfer and withdraw funds.

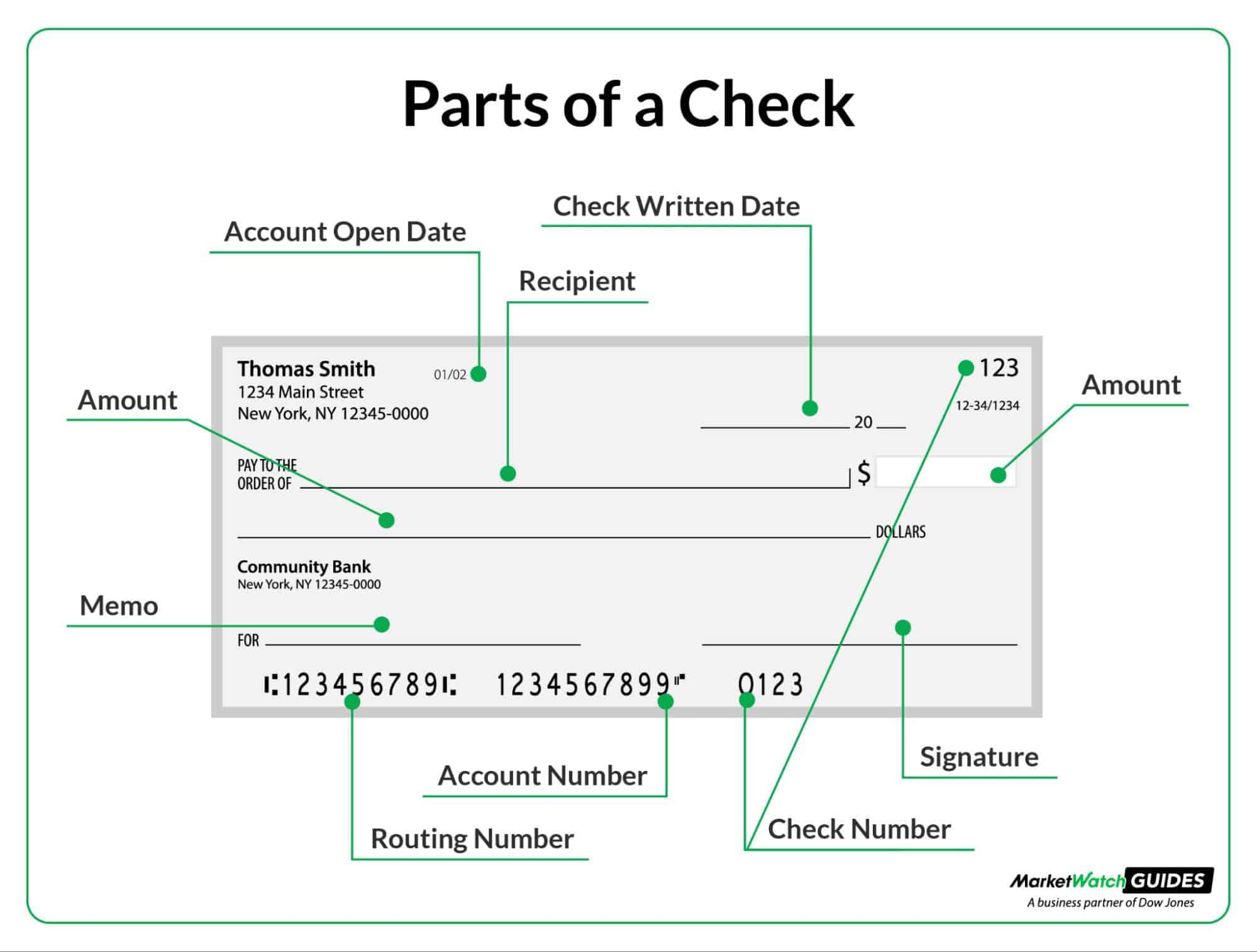

Now look, checks are not an archaic practice. For big purchases, some companies require checks, so do not skip learning how to write and read a check.

Look at this image below to better understand the anatomy of a check.

Savings Accounts

So, you have a checking account, good, now it’s time to meet checking accounts best friend: the savings account. In your checking account, you are storing money that can easily be taken out, put in, etc., but what about the money that you don’t necessarily need to spend right away? A savings account is where you are going to store all the money that you will need for emergencies or future big purchases you are saving for.

Money can be deposited in this account via online transfers, in the bank, or via checks deposits. The great thing about savings accounts is that you can actually make money with them through the concept of compounding interest.

Say you initially put $2,000 in your savings account. Each month, for 25 years, you plan on putting $200 in there every month. You also have an interest rate of 5%. In 25 years, you will make over $120,000 dollars. That’s the beauty of compound interest.

Money Market Accounts

Unlike the standard savings accounts, money market accounts pay higher interest and are a little less flexible when it comes to transactions. Always speak with your bank and make sure you are aware of their stipulations.

Some of the disadvantages of money market accounts is they may have tougher restrictions on withdrawals and may require a larger deposit, however, can be highly beneficial to you as well. Some of the advantages of money market accounts include safety and security because they can be FDIC insured, depending on the bank, and due to higher interest, can get you higher returns.

Certificate of Deposit Accounts

A Certificate of Deposit, also known as a CD, is a length-based special savings account where you are generally unable to make any withdrawals for a certain period of time.

Say in 3 years, you plan to make a big purchase, so you decide to buy a CD. You put down an initial deposit of $50,000 on a CD with an interest rate of 4.5%. Within the 3 years, you will have made roughly $57,000.

Certificates of Deposit are also protected by the Federal Deposit Insurance Corporation (FDIC) and can be insured for up to $250,000.

Opening a Bank Account

Now that you know about each of these accounts, how can you get started?

Let’s first understand what you need to start a bank account. You need:

- Your Social Security Number (SSN)

- A government-issued photo ID

- An ID

- A passport

- A driver's license

- Money Market Accounts

Conclusion

Make sure you have all the necessary information and materials before you waltz into a bank. Don’t just go into one thinking you can deposit whatever and start whatever.

Banks have specialists that can help you decide what is best for you, so make sure to utilize all of your resources.

Written by Doreen Chirwa · My Growing Pains